Welcome to Future Beat— a pulse on posterity. If you haven’t yet, join hundreds of curious minds by subscribing.

Hi everyone,

Oracles have prophesies; VCs have theses. I want to talk about a rare insight that was both— a prophetic prediction AND investment strategy. Which one? The famed 2011 proclamation “Software is eating the world.”

Specifically, I want to honor its accuracy, while questioning, humbly, its relevancy today.

Marc Andreessen’s prediction was totally right. A decade+ later, software has disrupted industries while creating new ones. Self-checkout kiosks, chatbots for customer service, ride-hailing, e-commerce, movie streaming, telemedicine—software didn’t just eat the world, it devoured it.

But things are changing. Initial proof-points: F2023 startup bankruptcy rates, longer sales cycles, increased customer acquisition costs, decreased contract values (i.e. plummeting LTV/CAC), on top of timid/sidelined dry powder. Some say “It’s the Economy, Stupid.” A partial truth— surely. But the whole truth? I think not. My view, software ate the world— but it might very well be “stuffed.”

What does this mean? Where do we go from here?

My thoughts below (+as always, scroll to bottom for awesome job openings at awesome startups).

Drum roll please…. 🥁

Pete

Software Ate the World

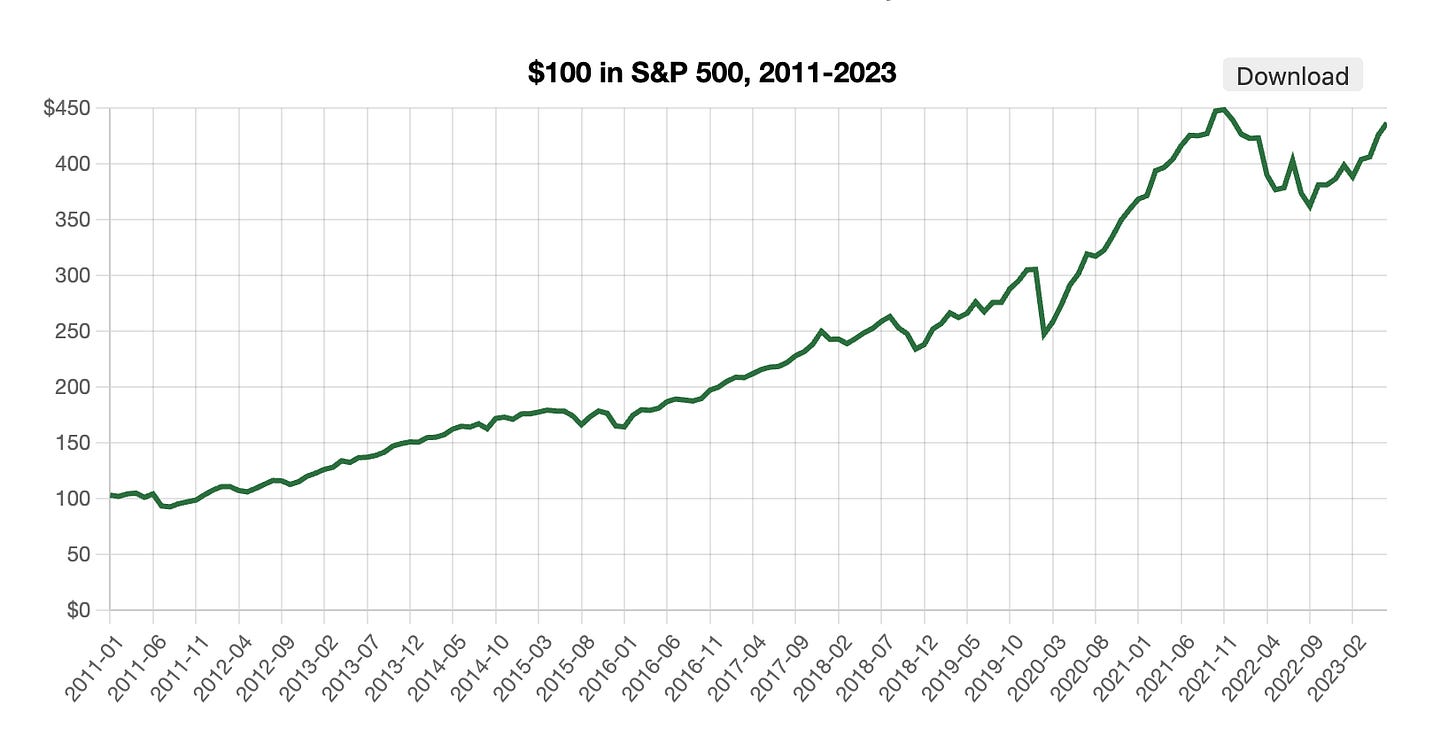

Marc Andreessen's "software is eating the world" prediction in 2011 was like Babe Ruth calling his shot in 1926. He pointed; it happened. Just look at the tech-heavy S&P 500 in that time:

“Software is eating the world” was not just prophecy— it was strategy. If you were long on the digital transformation of business and society and simply held the S&P 500 you would have done well: if you put $100 into the S&P 500 in 2011 and kept reinvesting your earnings, you'd have around $436 by the end of 2023 (a sweet 337% return or about 12.5% per year).

Of course, there is more to the story: those returns were driven by just a handful of companies in the S&P 500: Microsoft, Apple, Alphabet (Google), Meta (Facebook), and Amazon. Still, look to virtually any area of your life and try and find a place untouched by software. It’s hard, because it’s true. Software has eaten the world.

Mr. Andreessen was right— prophetical, and accurate.

But times change.

Descent from Consequential

Many of you will probably not agree with this. My view: software once devoured industries— but now it’s just snacking. I call this a “Descent from Consequential.” A gradual decline from software devouring (2000s), to eating (2010s) to now snacking (2020s). Here’s my chart:

The descent goes:

Tech giants like Facebook, Amazon, Spotify, PayPal dominated the early 21st century, devouring industries.

Wave 2 brought incremental changes, less radical than Wave 1.

Now, in Wave 3, software is more like snacking, influencing niche areas.

Still, venture-sized returns are possible in these corners— but their softwares are unlikely to deliver order-of-magnitude changes in business and society (with the exception of software+hardware horizontal tech like Artificial Intelligence).

What’s the proof? The data?

Inflection Proof points

What data are there for this “Descent from Consequential?”

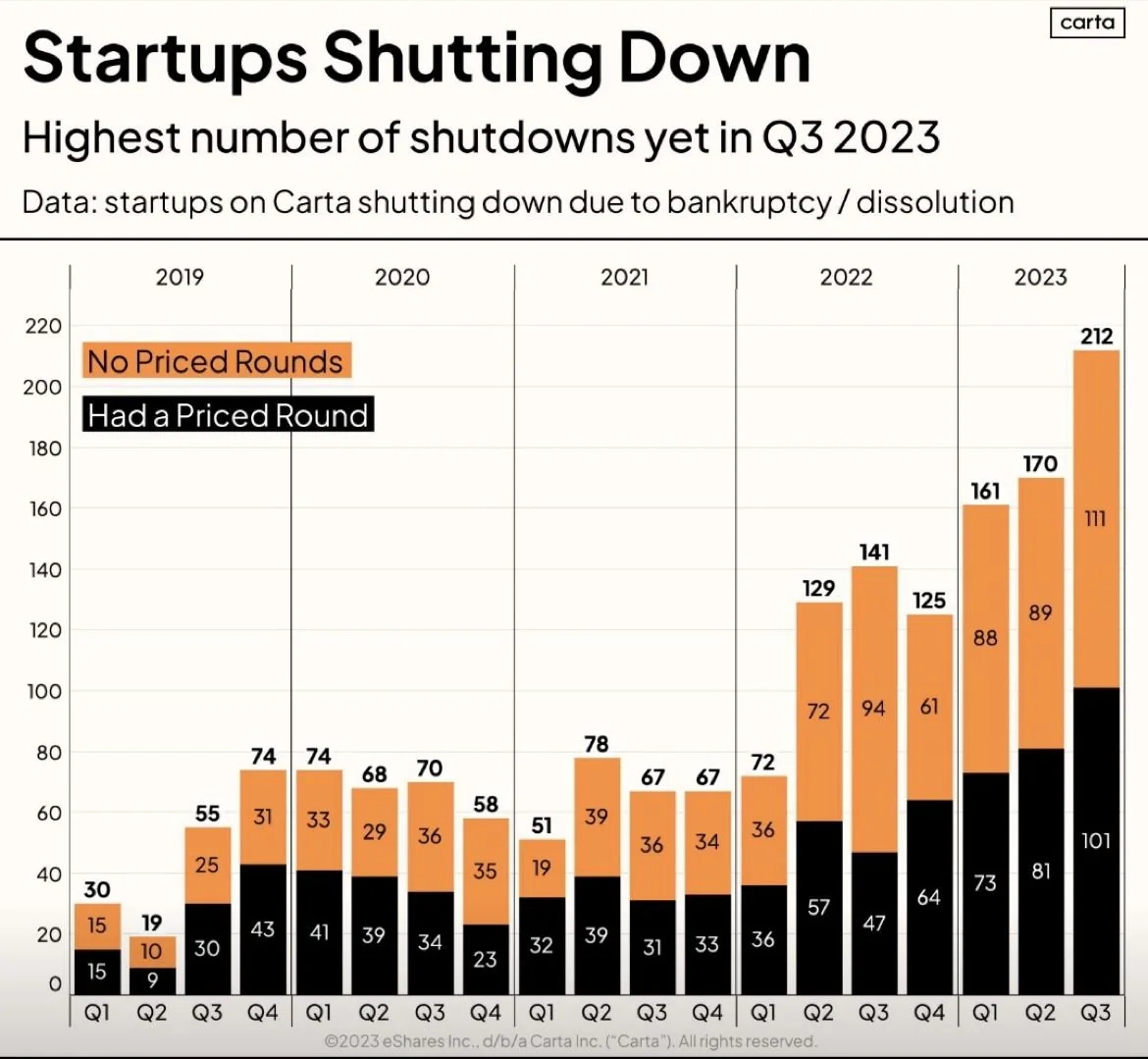

First, Q3 2023 saw the highest number of startup shutdowns in years (per Carta data):

Second, software startups are struggling on sales and profitability metrics. Here are three quick facts from Capchase. Since 2022:

CAC has surged by 180%, hitting top-performing companies hard.

CAC payback has increased by 150%, signaling longer cost recovery periods.

Median LTV/CAC dropped by 47%, indicating reduced customer acquisition profitability.

Capchase describes:

“Since the end of 2022, the SaaS market has been in a downward trend, and founders, investors, and customers alike are seeing the effects. Everyone is tightening their purse strings, and many SaaS companies are noticing that it’s become increasingly difficult to close sales and generate revenue.”

Most blame the economy for this stasis. But this may not be an “It’s The Economy Stupid”-Moment. Couldn’t it be something else? What if we are in fact at an inflection point, where software with its ferocious appetite is now stuffed? Or put another way, what if the Decision Makers are fatigued— or “good for now”— with software solutions to their most pressing challenges and opportunities?

Take fintech. Fintechs saw a 33% drop in global funding to $63 billion in the past 18 months, leading to massive layoffs. People blame rising interest rates, overfunding, and generally the macroeconomics for the bloodbath. But no one is asking the question: could it be that the CFO, the VP of Finance, the Consumer looking for Alternative Investments is simply “good for now” on new apps, new products and services to make their lives, their businesses better? How many Buy-Now-Pay-Laters do we need? How many digital payment apps or Crowdfundings do we need? Again, it feels the root cause of struggle is not “It’s the Economy” but rather “It’s the Technology.”

Ceiling: The Web is World-Wide

One other reason software may not continue to eat the world at existing rates: Internet Saturation.

We now have 4.7B of Earth online. The “Software is eating the world” thesis was delivered in 2011 when the world had 2B people online (so there was 2X+ of headroom).

Buy maybe we’ve reached a ceiling, at least in some geographies? For example, in the United States though, internet penetration rate is 91.8% of the total population (as of start of 2023). With U.S. startups receiving 50% of global funding, amounting to $11 billion in October 2023, there's a risk of a saturated market where use cases may become redundant or less important due to finite human interests and spending priorities.

What happens next?

My view: software has been eating the world— but now it’s stuffed. It’s had breakfast, lunch and dinner. 🍳🍔🍕 Once devouring industries, software now nibbles at enterprise edges. Eating snacks, not meals.

What happens next? My view: the physical or “IRL” world, things we touch, feel, live among, need will be of highest essence. Things like #energy, #security, #healthcare, #infrastructure, and #transportation, for starters.

A generational reset in innovation impulses is underway. If you want more on this beat, I wrote about where I think things are headed here.

You all know: I hold firm opinions loosely. Especially if you disagree, I would love to hear from you.

As always, awesome jobs at awesome companies below!

Pete

Pete’s Picks: Cool Jobs, Cool Companies

There are open positions at some really cool companies. Check them out: